Over the last few years, we have observed generally low electricity and natural gas prices in the country, even more so in the Illinois market. This year, we have seen some price advances in other

regions of the country, and while they have not hit the Illinois market yet, we would like to educate our readers on some of the different procurement products that help combat volatility.

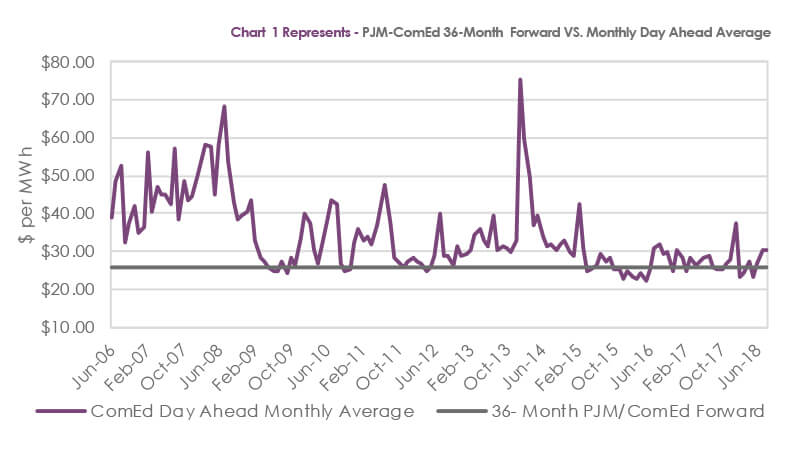

We continue to recommend to most of our Illinois-based customers that they lock in fixed natural gas and electricity prices at these low levels and certainly in consideration that the forward curves have been in such deep backwardation for both electricity and natural gas the last 12 months or so. Recently, we have often referenced that the current spread indicates that forward prices (especially longerdated prices) are cheaper than current spot prices and cheaper than most historical spot prices as shown in Chart 1. In this example, the 36-month forward price is $25.66 per MWh, which is 3.06% below the lowest ever yearly day-ahead average price of $26.47 per MWh recorded in 2016, 9.12% below the $28.00 per MWh spot price observed YTD 2018 and 33.78% below the $34.33 per MWh average observed since 2006 when PJM/ComEd changed to locational marginal pricing (LMP). So, as risk managers, we advise customers to lock in fixed prices. That said, we have seen movements in other electric regions of the Eastern InterConnect where forward prices have risen to levels where flexible procurement products may offer customers with more of a risk appetite better opportunities to reduce their energy supply costs by receiving floating rate index pricing for some or all of their supply needs.

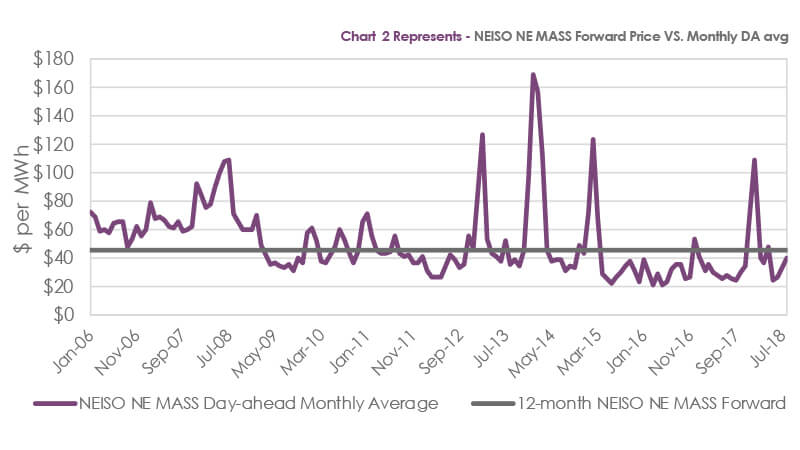

Although there are several regional electricity markets in the northeast that have seen higher prices this year, we will use the Northeast Mass Hub from the New England Independent System Operator (NEISO) as an example of why an index or hybrid product may make sense for Calendar 2019 despite the upside risks that exist with such a product.

A review of Chart 2 shows that the current 12-month NEISO/NE MASS HUB forward price is $45.23 per MWh. This compares to the $43.63 per MWh Day-ahead price observed for the last year. It is important to note that this price includes a $108.00 per MWh price seen in January 2018 due to very cold weather in New England. The market often seems to remember the most recent outlier pricing, so it appears the market is pricing in a similar event for this winter. That said, leaving all other price input factors equal, if the winter temperatures are normal to above normal in New England, then January pricing might be much lower, like the $40.22 price seen in January 2017 or the $38.63 Per MWh price of January 2016. If we substitute $40.00 for $108.00, then the $43.63 per MWh price seen in the last 12 months would become $37.97 per MWh, 16.05% lower than the current forward price of $45.23 per MWh.

So, exactly how would a customer who has a contract starting in January be able to participate in potential lower spot pricing as opposed to locking in a fixed price that has a $108.00 January price built into the fixed price? Most suppliers offer index products that allow a customer to receive the hourly price for their usage based on the hourly day-ahead spot price published by the relevant Regional Transmission Organization (RTO). In this example, it would be the New England Independent System Operator. Further, in many cases it is possible to lock in a portion of their

usage requirements and let the remainder receive the index price. These hybrid products allow customers to reduce some of their upside risk while still participating in lower spot prices if they do occur. Another feature of these products generally is that they allow the customer to lock in a fixed price at any point in the remainder of the contract for the prevailing market price at the time.

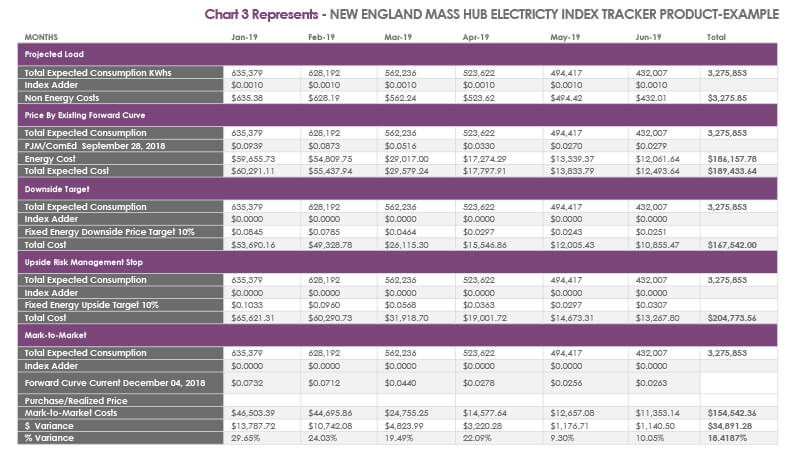

One of the difficulties in this approach is that there are a lot of moving parts that need to be tracked. As data-driven consultants, this is an area where Alfa Energy can help our clients keep abreast of all of the price movements. In Chart 3, we provide an example of a tracker program we provide to customers who want to receive index pricing. This example chart is just for six months due to space considerations, but we provide this analysis for as far out as market prices will allow.

Every day, there are forward curves published for the major hubs in the different regional transmission organizations. Alfa Energy keeps an extensive database of both forward prices and spot prices. As we have discussed, forward curves are just expectations for future spot prices, broken down by month. Let’s assume a customer decided on September 28th to enter into an index product for the period of January-December 2019 for the total expected consumption. Every day until day-ahead prices start to be published for Jan 1, Jan 2, and so on, the customer has exposure to the forward curve. Using our database, we populate the tracker with the forward price each day for the relevant month. We have 10% upside and 10% downside targets (the percentage target set is after consultation with the customer) that can create triggers to lock in prices. We provide these reports to the customers as often as they would like to see them and always when there is an outsized move either way. This is an example, but if there was a situation where the winter 2019 forecast for New England in early December 2018 was mild, forward prices would start to decline, and the customer could then choose to lock in a price that would be cheaper than on September 28th. Obviously, it could also be higher.

There are three characteristics of electricity pricing that are true:

- They are mean-reverting

- They are event-driven with extreme upside risk

- They can be very volatile due to the general inability to store electricity (we acknowledge that is changing with emerging battery storage technologies but feel that characterization will

remain for the first few years)

The purpose of these index products is to provide customers flexibility in managing their energy spend against budgets in markets with these attributes in exhibition and where forward prices have risen above historical price averages. Please feel free to contact us for further information on flexible procurement products for both electricity and natural gas.

Analyst – David Mousseau

Source – CME Group, PJM, New England Independent System Operator, and Reuters